For Business Corporations

Case Study

Are you facing these kinds of problems?

There is no successor

Need to sell off a subsidiary or a business division

Need a temporary shareholder to replace the current major shareholder

Need to increase capital or procure growth funds

Strengths & characteristics

Strength 01 We provide funds appropriate to the problem

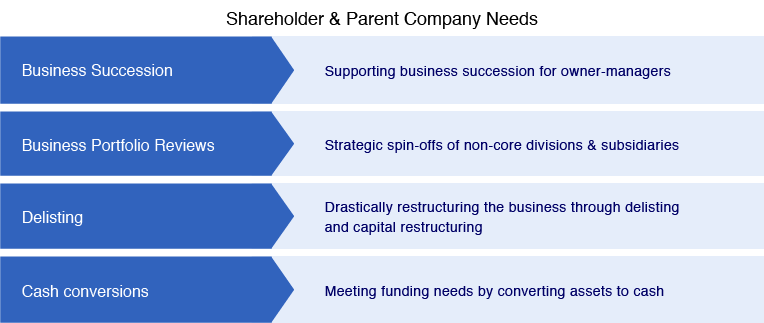

We coordinate with each company including the Mizuho Financial Group as appropriate to respond to the diverse funding needs of business companies.

Strength 02 We have personnel who can offer support to solve management problems

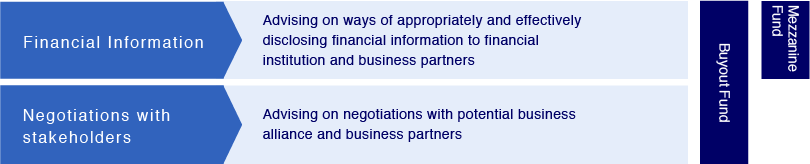

As well as providing capital as a fund, we also offer appropriate support to improve governance, increase corporate value, and negotiate with stakeholders, etc.

Examples of Our Participation in Improving Governance and Increasing Corporate Value

Examples of participation in negotiations with stakeholders such as financial institutions and business partners

Strength 03 We undertake long–term investments

While PE funds normally implement an exit in 3–4 years, funds whose management is entrusted to MCP Partners offer a wide range of support such as improving corporate control systems over a 5–7 year period.