Case Study

MCP Partners (hereinafter the “Company”) liaises with each company including Mizuho Financial Group companies as appropriate to respond to the diverse funding needs of our various customers such as business companies and financial sponsors.

Typical Needs

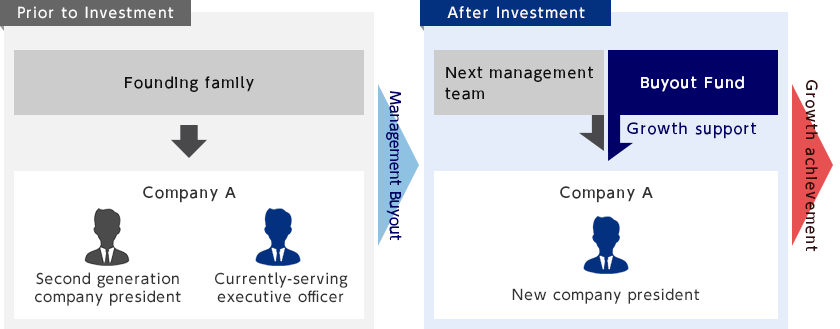

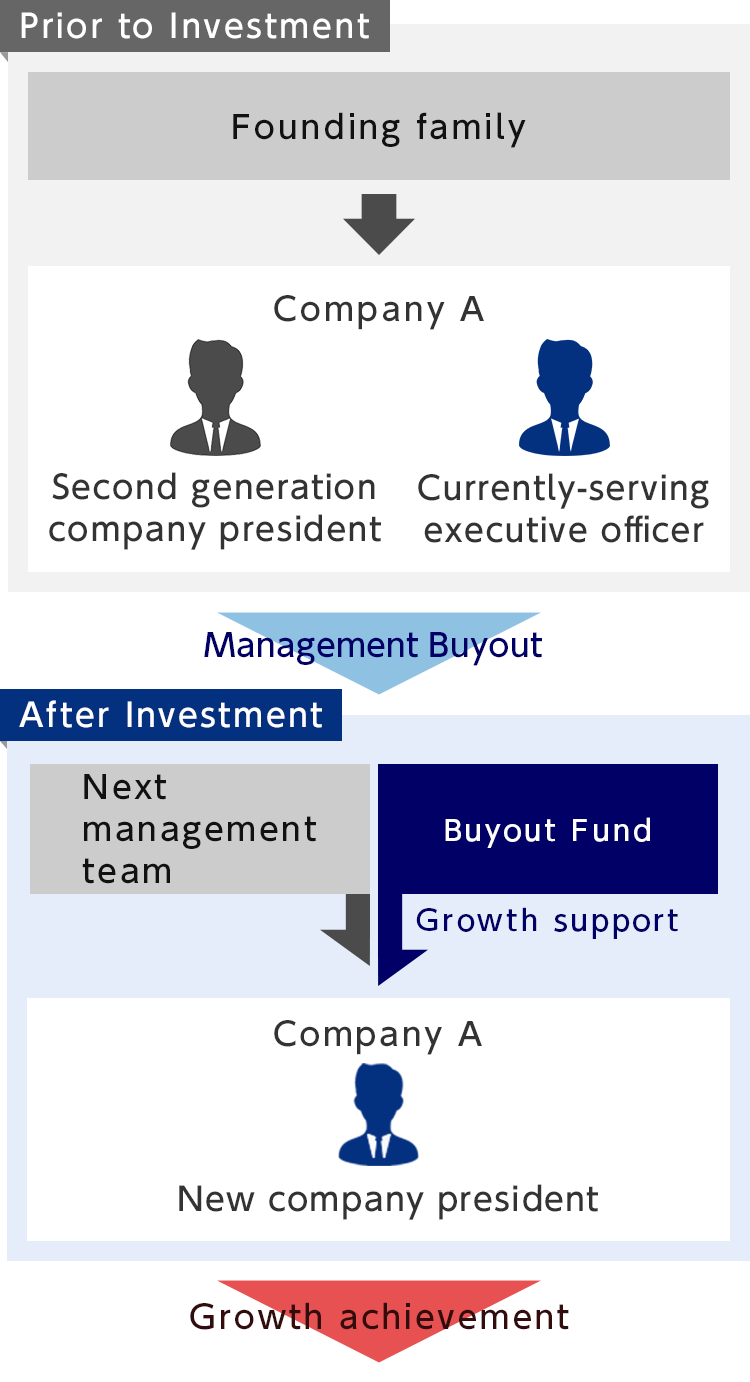

Business Succession

Details of needs prior to investment

The founding family owns the majority of the stock. The eldest son of the founder has served as the second generation company president but now there is nobody among the relatives to take over the business; this creates a succession problem in terms of both stock and management.

Investment Details

One of the currently–serving executive officers, who is not from the founding family, becomes the next company president and a management buyout is executed under collaboration between the next management team and a buyout fund whose management is entrusted to MCP Partners.

After Investment

As a result of the assistance of MCP Partners, the business company achieves growth through overseas business expansion and the clarification of corporate controls.

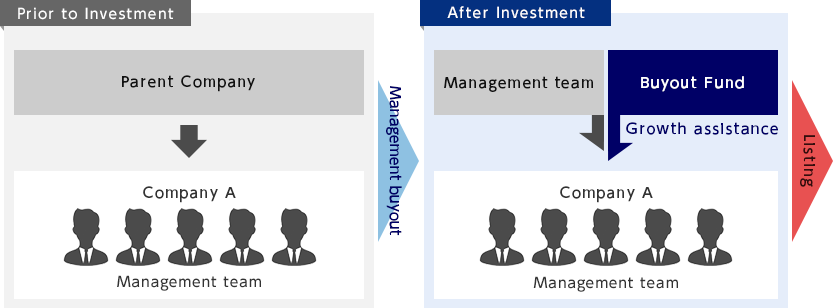

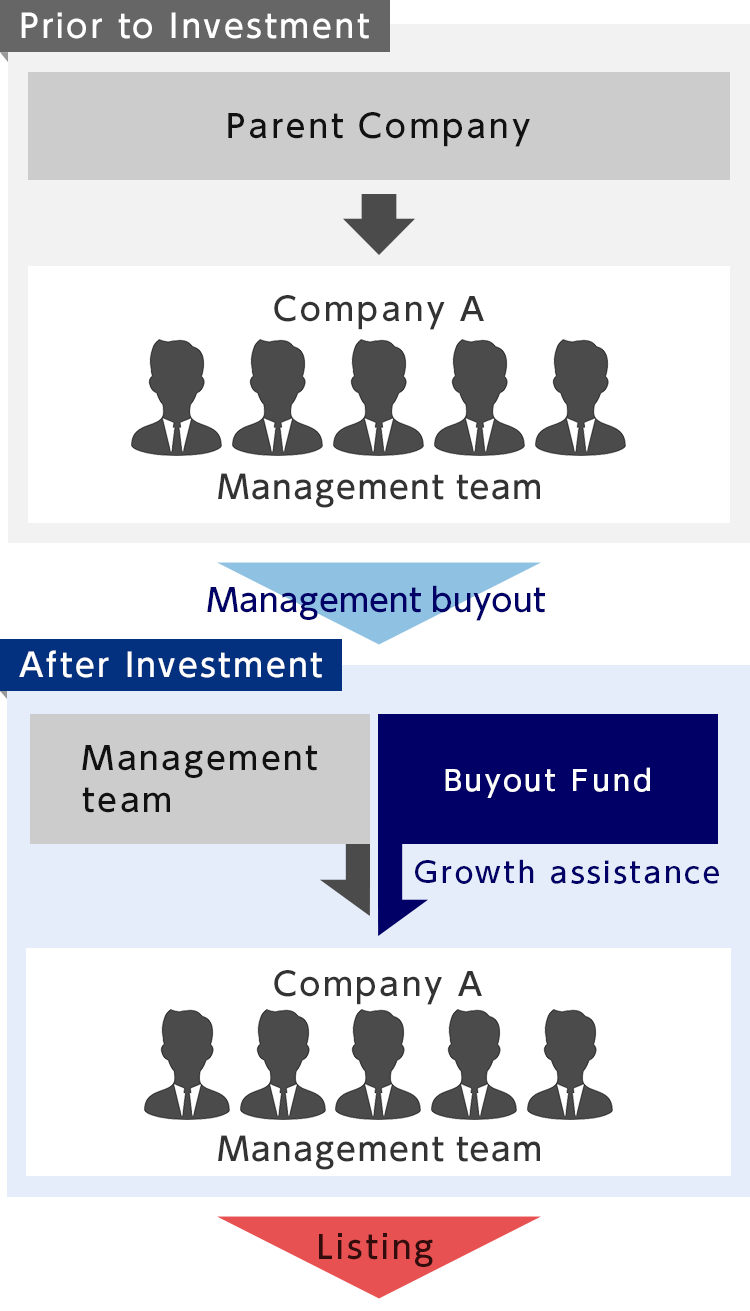

Independence of subsidiary company

Details of needs prior to investment

Company A’s management team looks at changes in the business environment and aims to enhance its competitiveness; however, from the parent company’s point of view Company A is not in a core position and therefore it is not allocated sufficient management resources.

Investment Details

Company A’s management team carries out a management buyout with the assistance of MCP Partners.

After Investment

As a result of the assistance of MCP Partners, there was an increase in investment in personnel and productivity improvements The business company also acquired an upstream enterprise necessary to improve its competitiveness; and ultimately its stock was listed.

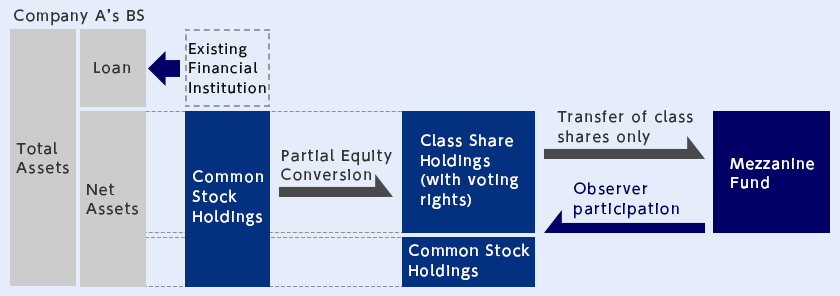

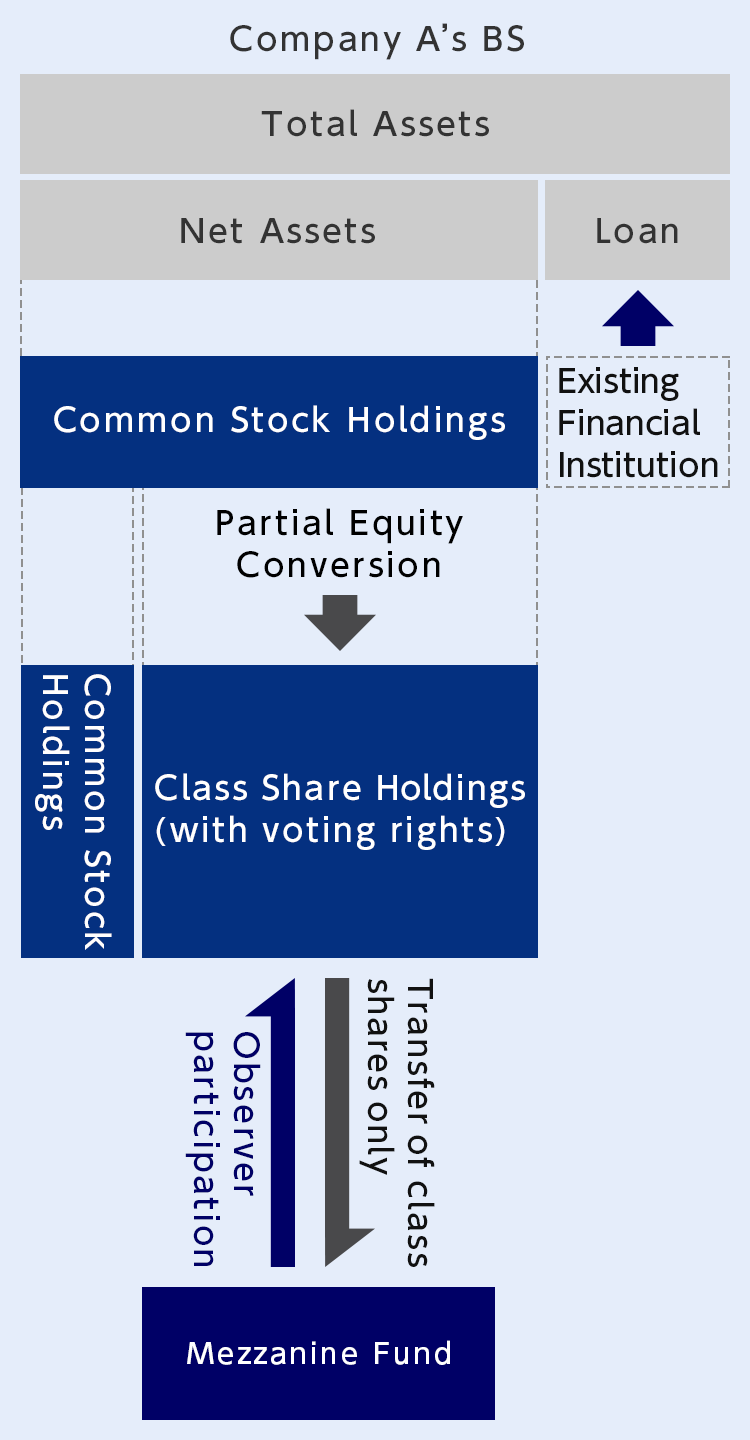

Major shareholder disposal needs

Details of needs prior to investment

Major shareholder(s) wish to sell shares they own (less than 50%).

There are concerns about the shares going to investors with divergent interests and destabilization of the management base.

Investment Details

Ownership of the shares is temporarily transferred to a Mezzanine Fund whose management is entrusted to MCP Partners.

After Investment

Stock is sold at a fixed price to an assignee agreed in advance, or converted into class shares which are redeemed through the buy back of treasury stock using the company’s accumulated earnings.

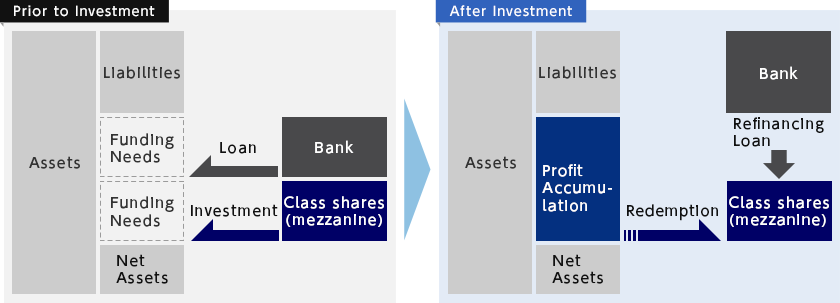

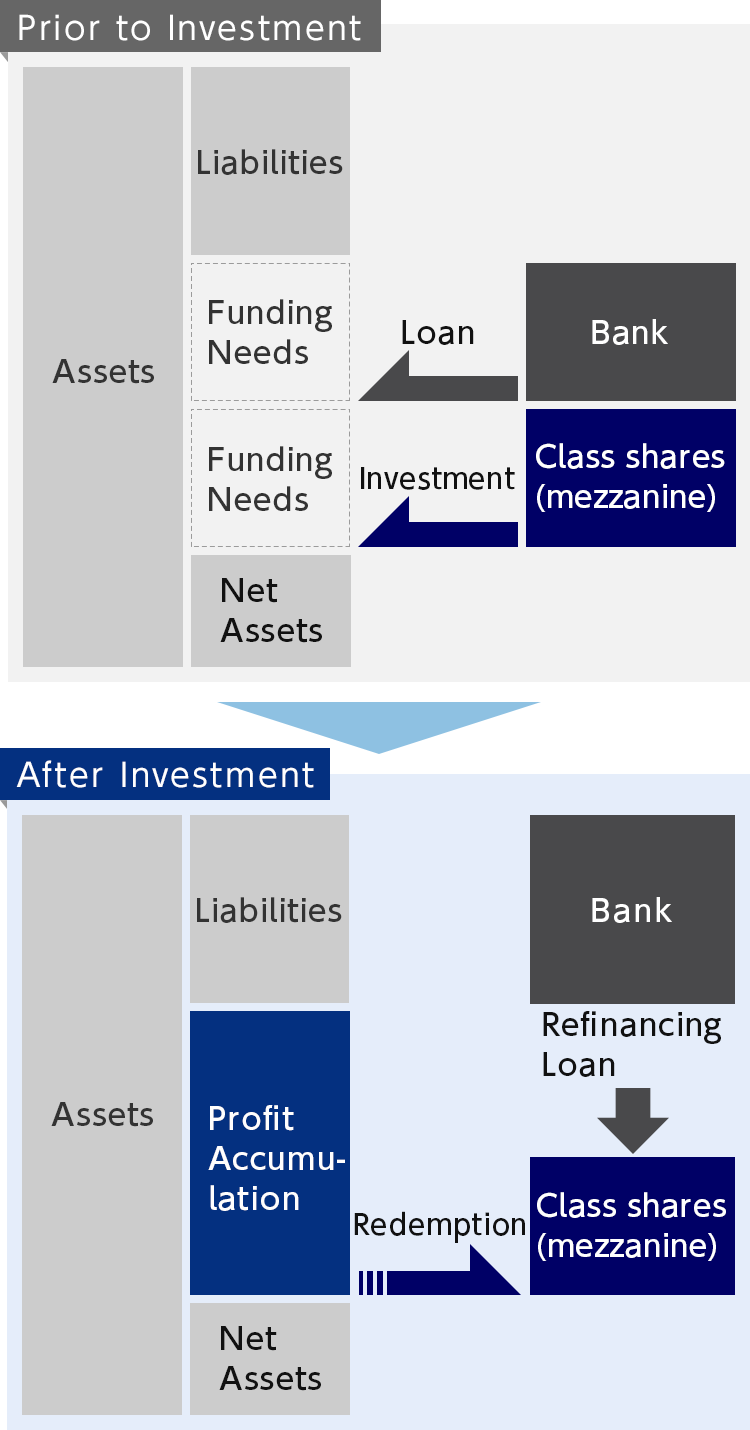

Growth Funding Procurement

Details of needs prior to investment

This is an enterprise in a growth phase with a strong demand for capital funding. There is little shareholder equity and it has been difficult to secure the funding needed with banking support alone.

Investment Details

Funds are procured through a combination of mezzanine (class stock) investment and bank procurement.

After Investment

The mezzanine funds whose management is entrusted to MCP Partners underwrite the investment with class shares; this is not only used to increase funding for production facilities but also to increase shareholder equity.

After the investment, in addition to increasing and enhancing production facilities to cope with extraordinary demand, a project is set up to improve performance and after that class shares are redeemed through accumulated profits.