Mezzanine Fund

The mezzanine funds that MCP Partners are commissioned to manage primarily provide funding through class shares, subordinated loans, and subordinated debt (generally with no voting rights attached.)

We provide funds necessary to expand shareholder equity, execute management strategy, and to allow business successions and corporate acquisitions, etc.

After investment has been made, our basic policy is to recover investment capital from the profits accumulated by the investee company, or through refinancing.

Management Track Record/Company History

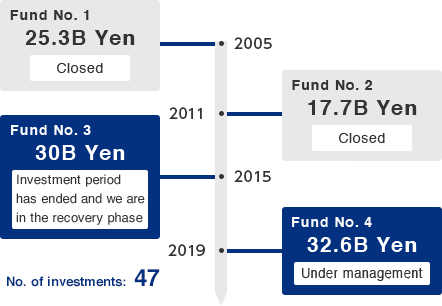

Since the Company began business operations in the year 2000, we have been commissioned to manage a cumulative total of four mezzanine funds (with Fund No.4 on–going).

as of October 2021

Fund details

Fund No. 1

| Established | 2005 |

|---|---|

| Commitment Amount | 25.3B Yen |

| Cumulative investment amount | 27.2B Yen |

| Number of investments | 15 |

Fund No. 2

| Established | 2011 |

|---|---|

| Commitment Amount | 17.7B Yen |

| Cumulative investment amount | 16B Yen |

| Number of investments | 13 |

Fund No. 3

| Established | 2015 |

|---|---|

| Commitment Amount | 30B Yen |

| Cumulative investment amount | 31.1BYen |

| Number of investments | 14 |

Fund No. 4

| Established | 2019 |

|---|---|

| Commitment Amount | 32.6BYen |

| Cumulative investment amount | 19.2BYen |

| Number of investments | 5 |

Investment Opportunities

Our mezzanine funds provide financing needs that cannot be handled by ordinary bank borrowing, such as capital increases and restructuring, procurement of growth funds, and acquisition financing.

Key investment models

- Supplying funds to improve the capital adequacy ratio and for growth

- Providing mezzanine financing for buyout transaction

- Disposals for minority & majority shareholders/genuine MBO

Characteristics of Mezzanine Funds

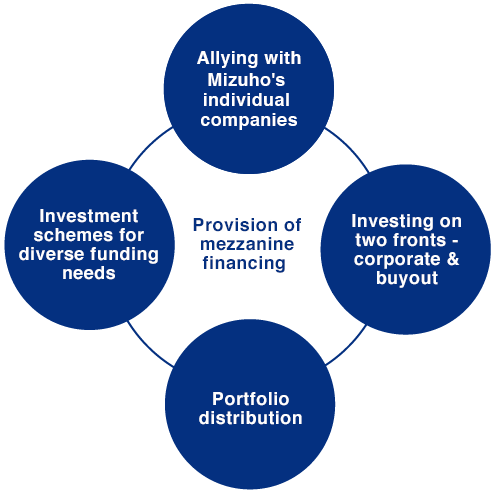

We provide mezzanine financing based on the know–how that we have accumulated as a pioneer in the Japanese mezzanine finance market.

Leveraging Mizuho’s resources

- Allying with individual companies in the Mizuho Financial Group

Investing on two fronts – corporate & buyout

- Building up stable investment performance by investing on two fronts – capital funding needs for business companies (corporate mezzanine) and procurement needs for buyout financing (buyout mezzanine)

Portfolio distribution

- Distributing risk by spreading investments across a wide variety of sectors and investment formats

Investment schemes for diverse funding needs

- Capturing investment opportunities by not only providing simple funding but also by constructing “finance schemes” that best suit customer needs.