Buyout Fund

The buyout funds that MCP Partners are commissioned to manage will acquire more than 50% of common stock. We provide the funds necessary to arrange business successions, independence for subsidiaries, and for business companies to delist.

After the investment has been made, we support management reforms in investee companies and one of our fundamental strategies is to exit investments via IPOs (share listings).

Management Track Record/Company History

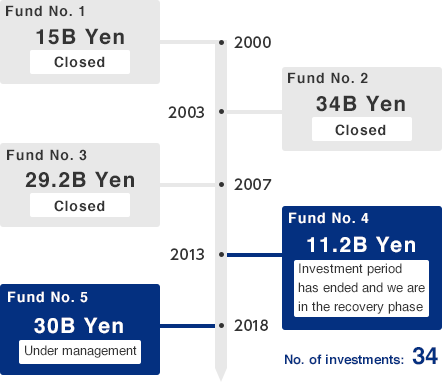

Since the Company began business operations in the year 2000, we have been commissioned to manage a cumulative total of five buyout funds (with Fund No.5 ongoing).

We have successfully arranged IPOs for

12 companies (across ten cases)

as of March 2021

Fund details

Fund No. 1

| Established | 2000 |

|---|---|

| Commitment Amount | 15B Yen |

| Number of investments | 10 |

Fund No. 2

| Established | 2003 |

|---|---|

| Commitment Amount | 34B Yen |

| Number of investments | 7 |

Fund No. 3

| Established | 2007 |

|---|---|

| Commitment Amount | 29.2B Yen |

| Number of investments | 6 |

Fund No. 4

| Established | 2013 |

|---|---|

| Commitment Amount | 11.2B Yen |

| Number of investments | 5 |

Fund No. 5

| Established | 2018 |

|---|---|

| Commitment Amount | 30B Yen |

| Number of investments | 5 |

Investment Opportunities

Buyout funds offer equity for needs such as business successions, independence for subsidiaries and business divisions, delisting, and capital restructuring, etc.

Key investment models

- Business Succession

- Spin–out

- MBO that accompany delistings

Special Characteristics of Buy–out Funds

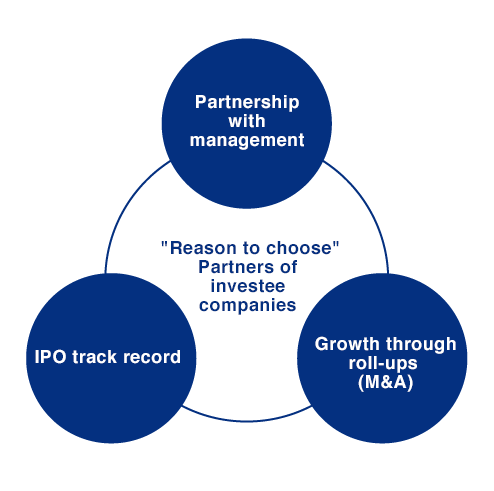

We work to achieve IPOs, after our investment giving a clear ”reason to choose” these funds from the point of view of shareholders, the parent company, and management.

Partnership with management

- Maximum respect for management’s autonomy

- An emphasis on dialog with management from the investment preparation stage

Growth through roll–ups (M&A)

- Allying with the Mizuho Financial Group’s individual companies

IPO track records

- Effectively implementing a policy of “IPOs through buyouts”